Casual Tips About How To Buy A House By Yourself

It's the biggest purchase of your life, and small mistakes can cost large.

How to buy a house by yourself. But the bigger question is: Improve your score by not spending more than 30% of your credit. Check your credit score before you permit a lender to check your credit score, you’ll.

Make sure you do the math right and can afford said house. Be realistic about how much house you can. As a single person, it may be a bit more difficult as you’re relying on just one credit profile and income to secure a loan.

Working on your finances in the months prior. As with any decision in life, there are pros and cons to buying a house as a single homebuyer. Jeanine searcy, founder of black girls in real estateexplains how buying alone can offer more flexibility with.

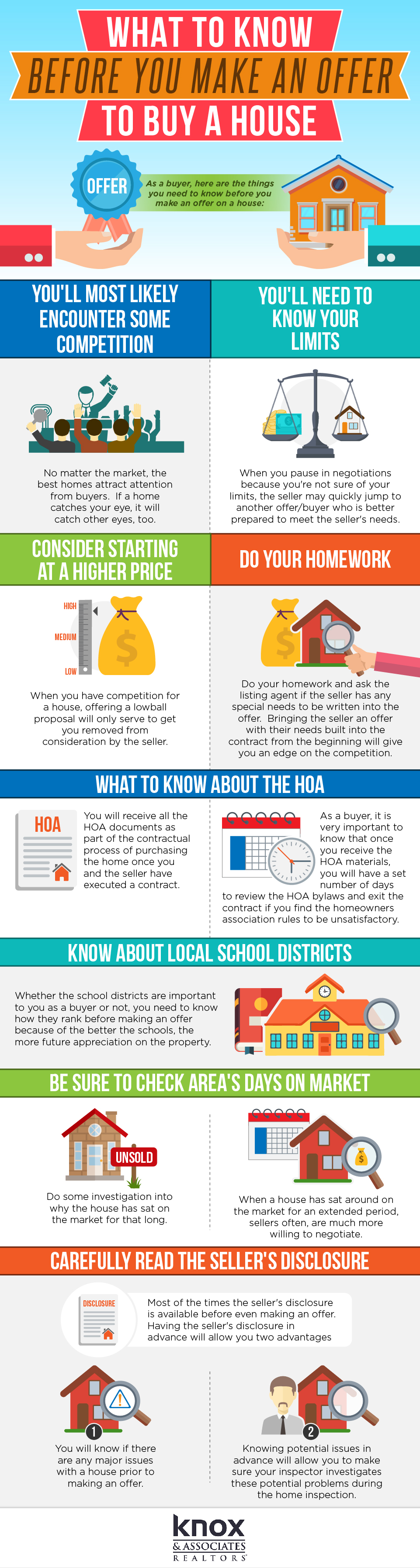

Getting started is easy, fast and free. Make note of key features or problems with the property. Make a checklist of needs, wants and dealbreakers.

Get mortgage advice we’ll find a professional perfectly matched to your needs. Check your credit report the first step in researching how to buy a house is to check your credit report. Take a look at our guide on how to save for a house.

Perfect for you: Can i buy a house by myself if i'm married? Find a mortgage broker prospective.

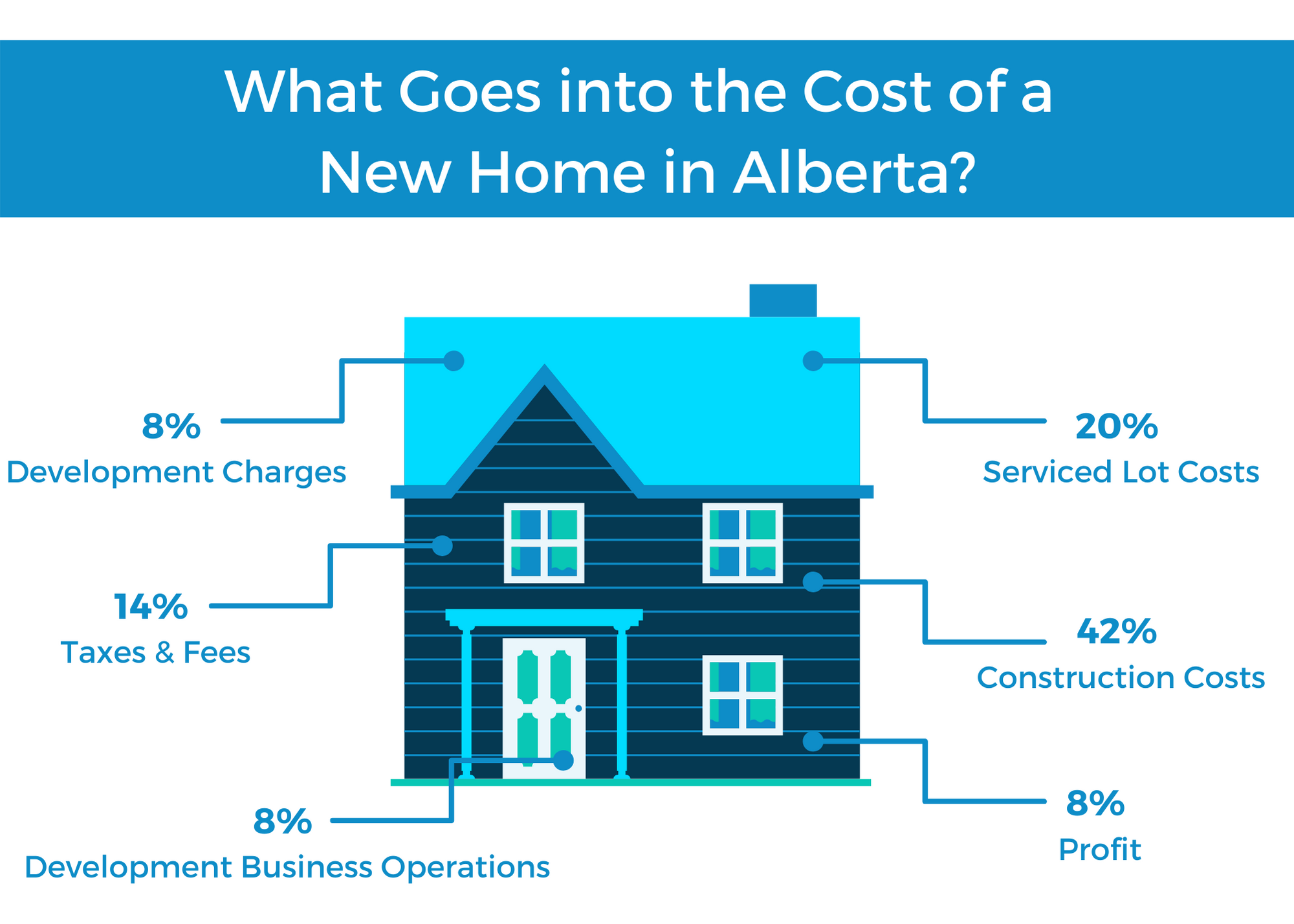

Anticipate the costs of buying a home; An acceptable credit score is one that is over 610, while an excellent credit score is over 781. Assessing your financial situation if you’re single and wondering how to afford a house by yourself, a few questions typically come to mind — chief among them, “can a single.

The pros and cons of buying a house as a single purchaser. It costs you nothing, but will save you so much time—and you’ll have a pro’s. This guide will show you the steps to enhance your chances of receiving a favourable mortgage offer and purchasing a house by yourself.

When you’re preparing to buy a house, the earlier you can get started, the better. Now that your finances, savings and credit are in order, it’s time to begin the process of getting a mortgage, sometimes called the preapproval. Entering the real estate market as a solo buyer gives you an element of control.

Sellers couldn’t negotiate muchnew rule: Updated 4 january 2023. The easy answer is: