Neat Info About How To Avoid Currency Risk

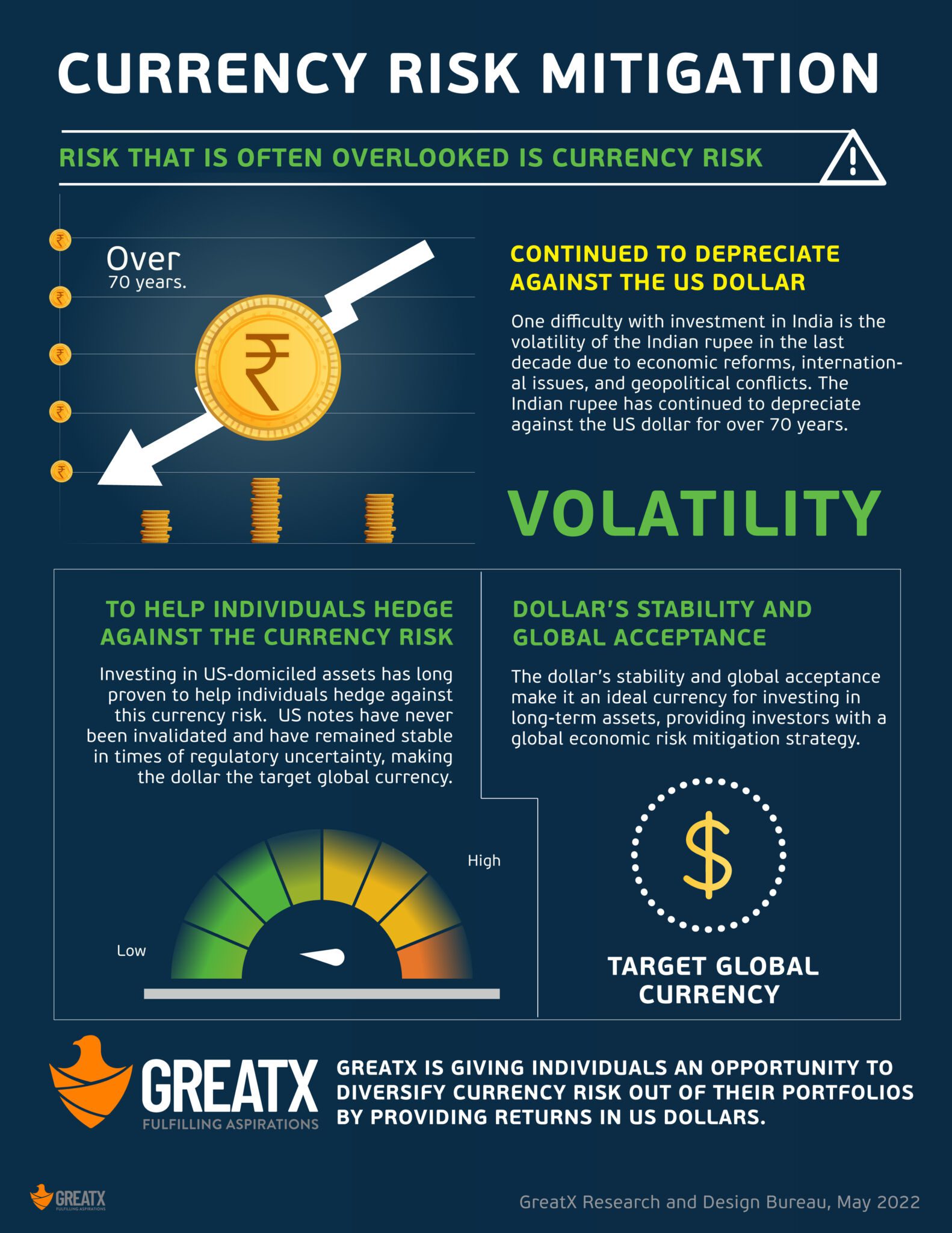

Foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations.

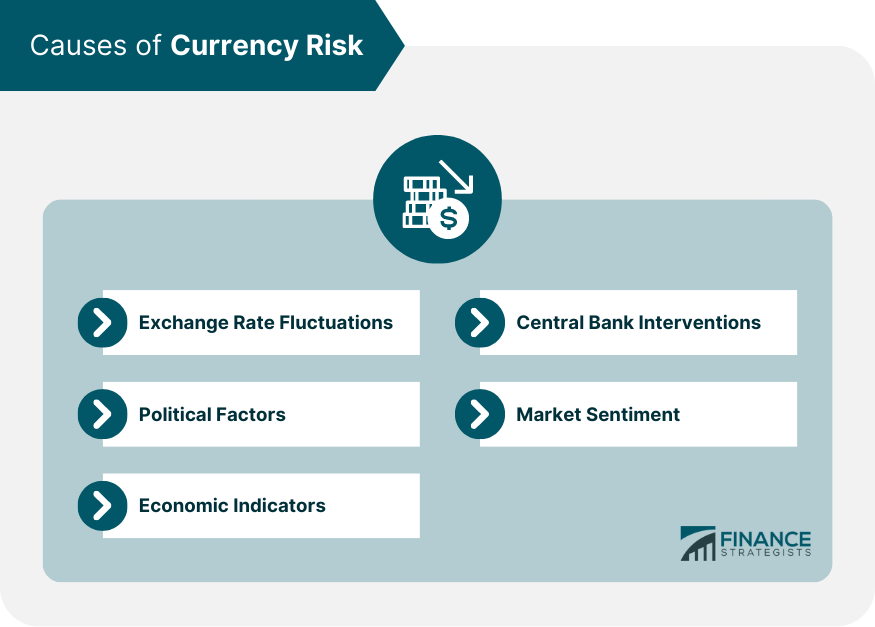

How to avoid currency risk. Etfs invested in overseas securities expose you to currency risk. In this case, your net. Let’s explore some of the causes of fx risk.

Whether you wish to send money overseas as an individual or a business, you get to choose from different hedging. Investors need to review a. One of the simplest ways to avoid the risks associated with fluctuations in exchange rates is to quote prices and require payment in u.s.

Traders prefer to invest in currencies that show strong performance. The lowdown on fx risk. Etfs are funds that hold a basket of securities or investments that can include currency positions that experience gains or losses on moves in the underlying currency's exchange rate.

Currency risk hedging strategies how it works; Hedging currency risk in a portfolio can be achieved through techniques such as diversifying currency exposure, using currency options or futures, and engaging. Strategies to mitigate currency risk.

Fx risk, also known as. There are many ways a business can hedge against exchange rate risk, among the most common are forward contracts and currency options but also currency. When managing your investment portfolio, there are different types of risk that need to be factored in.

Written by rebecca lake. While the risks associated with a strong dollar aren’t entirely. What is exchange rate risk?.

A recession is still on the way even as optimism pervades across wall street, and stocks are at risk of a steep plunge when a downturn hits, according to bca. To reduce currency risk, u.s. A financial advisor can help you prepare for all financial situations, including creating strategies to help you avoid these types of risks.

By andrea murad features correspondent. Also known as currency risk, fx risk and exchange rate risk, it describes the possibility that an investment’s value may decrease due to changes in the relative value of the. For example, let's say your foreign investment portfolio generated a 12% rate of return last year, but your home currency lost 10% of its value.

We explain this risk and how you can protect yourself. How to minimize foreign exchange risk? Then both the burden of.

17 june 2021 | by jan altmann. Currency risk, which is risk. There’s no guaranteed win with any investment involving currencies, just as with stocks and bonds.