One Of The Best Tips About How To Write A Payoff Letter

What is a mortgage payoff letter, what does it include, and how do you get one?

How to write a payoff letter. All of the expenses for a closing, such as real estate broker fee, legal fee,. No swimsuits allowed. For example, if you paid a contractor to repair a damaged wall and the contractor never performed the repair, this.

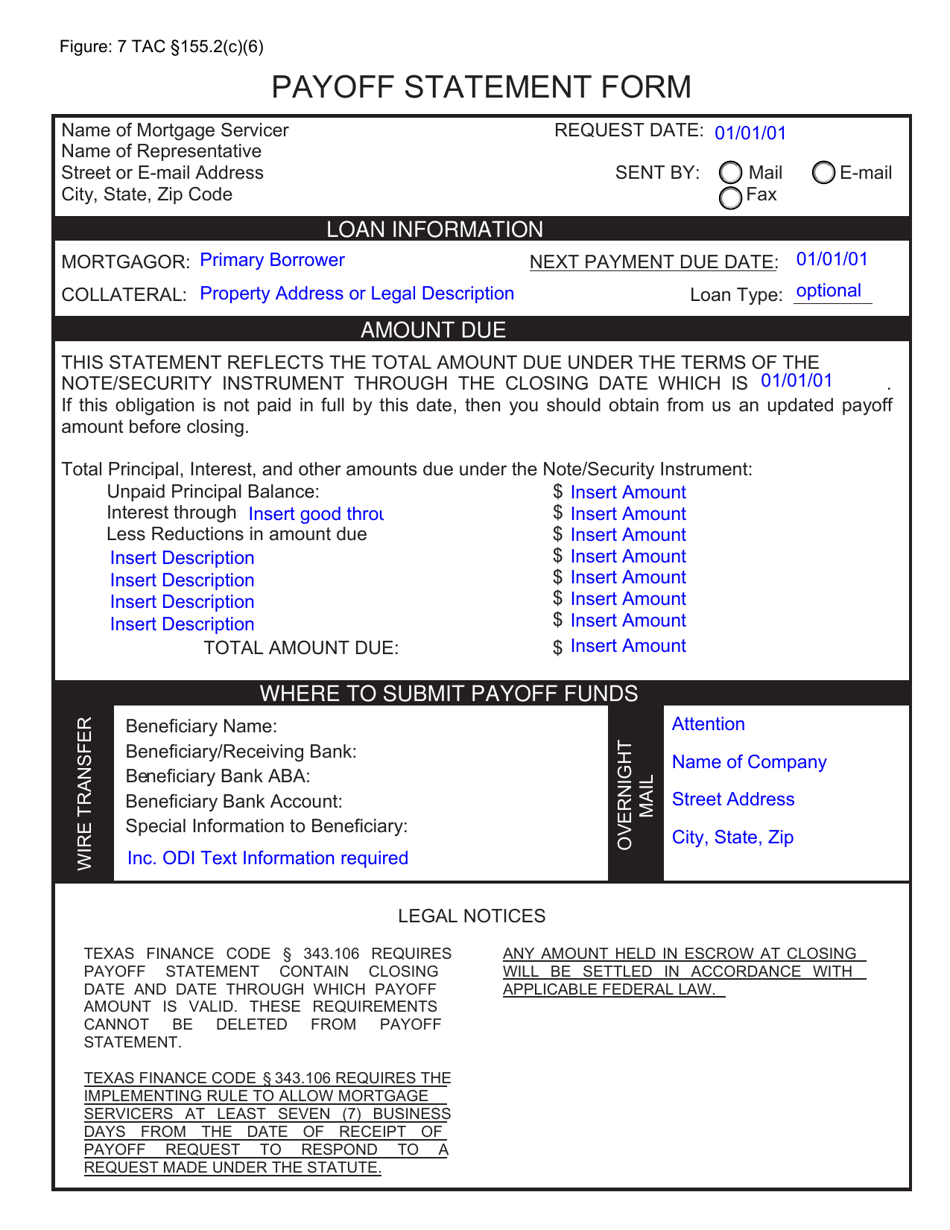

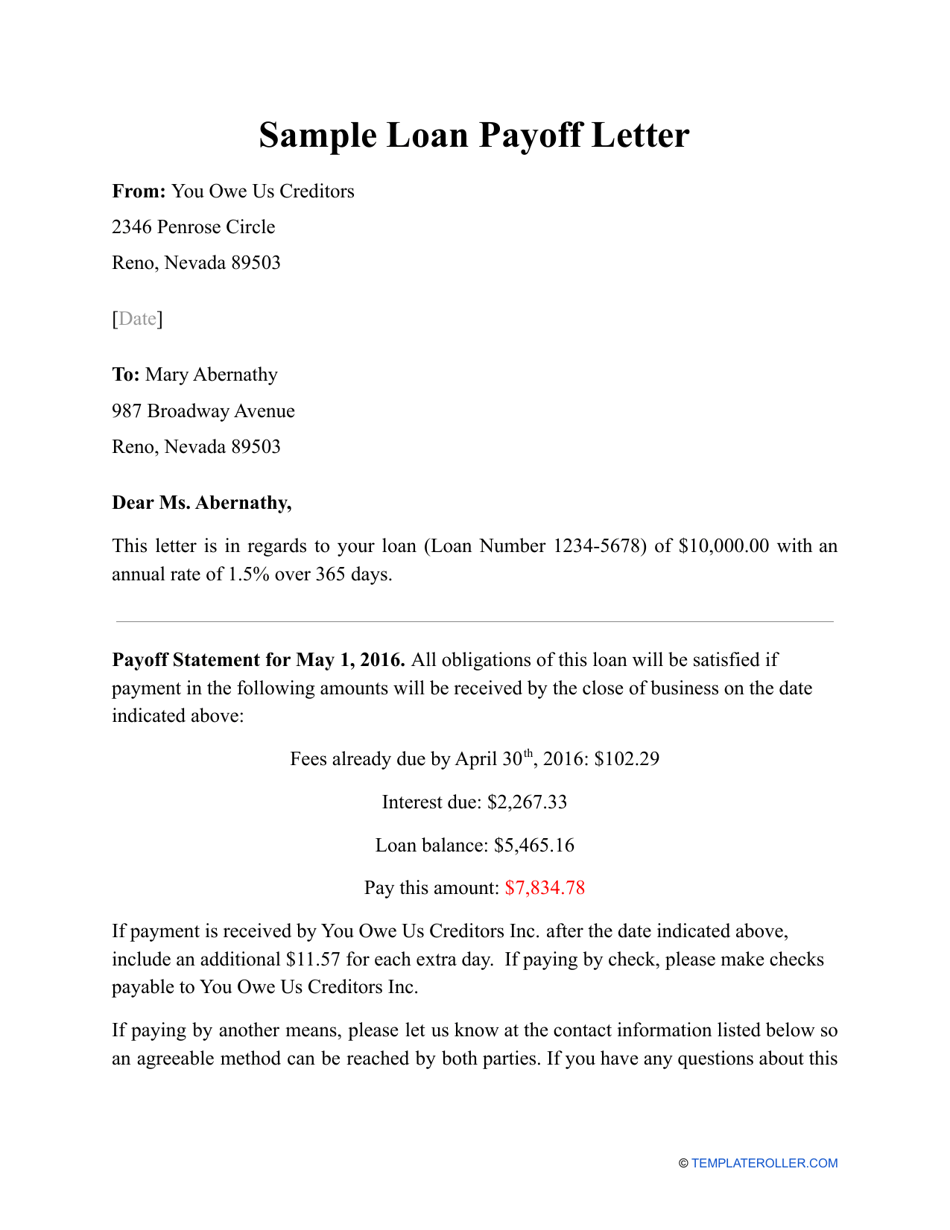

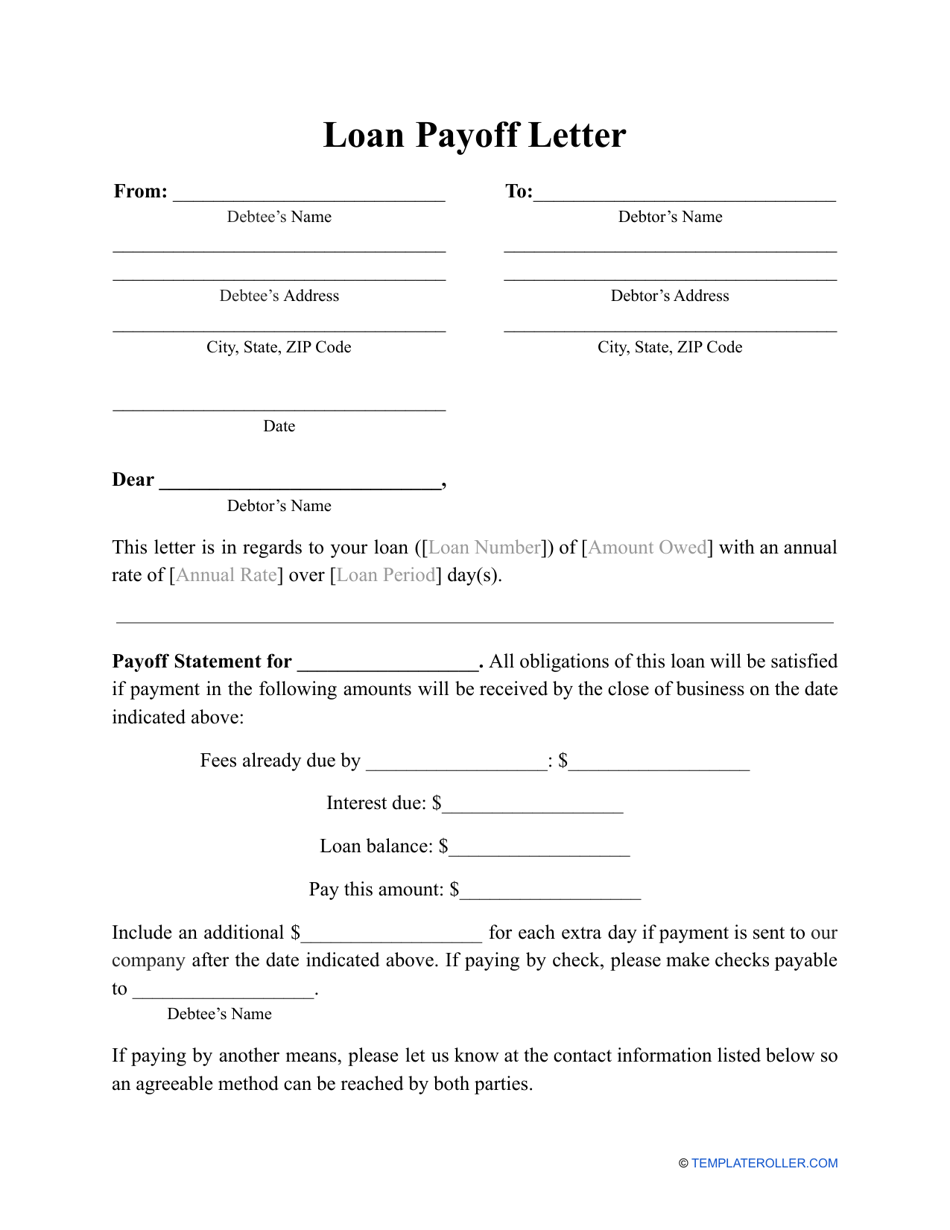

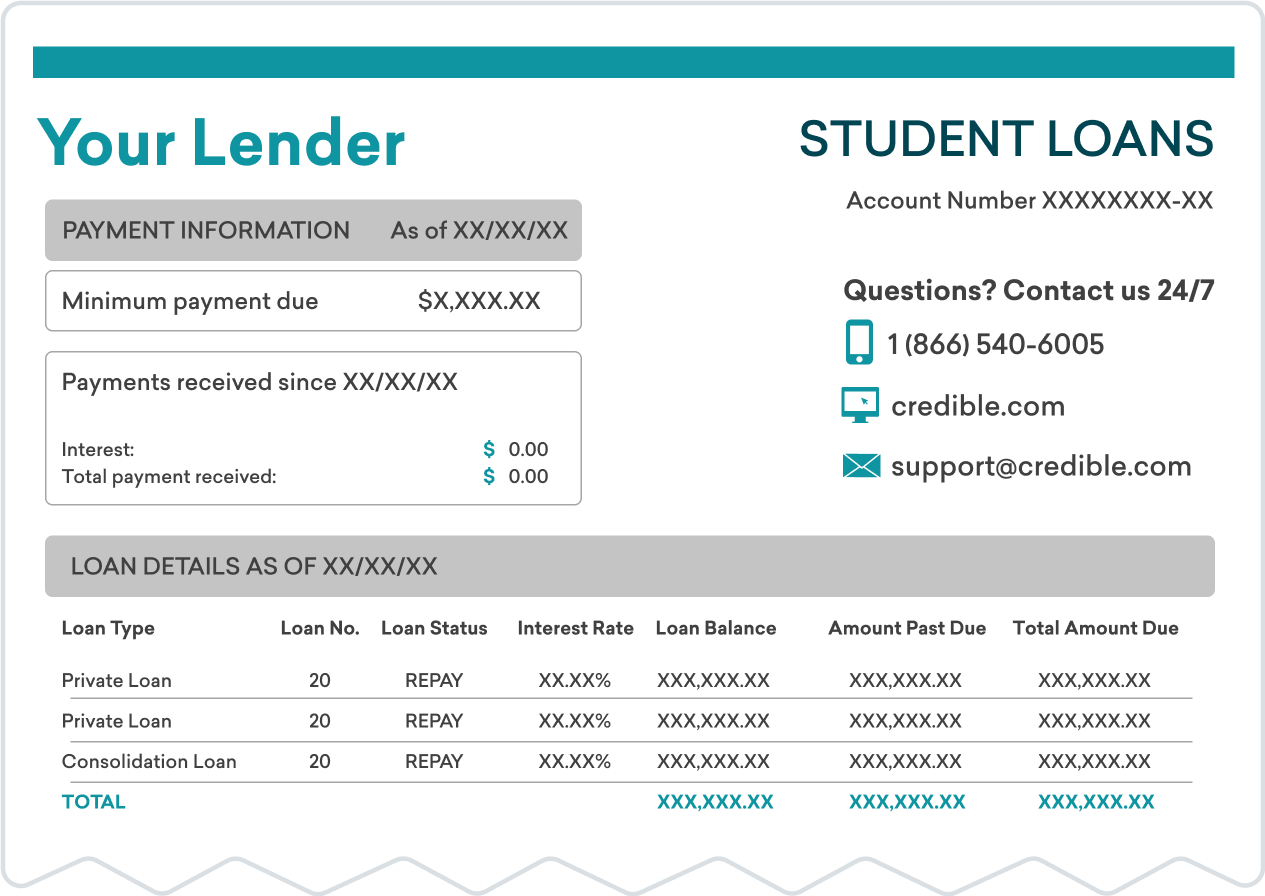

The date through which the payoff amount is valid. Austria and germany abound with spas called thermen — resorts with pools, saunas, lakes, restaurants, bars and treatment areas. A payoff statement is a document that shows how much money a borrower must submit to fully pay off a loan.

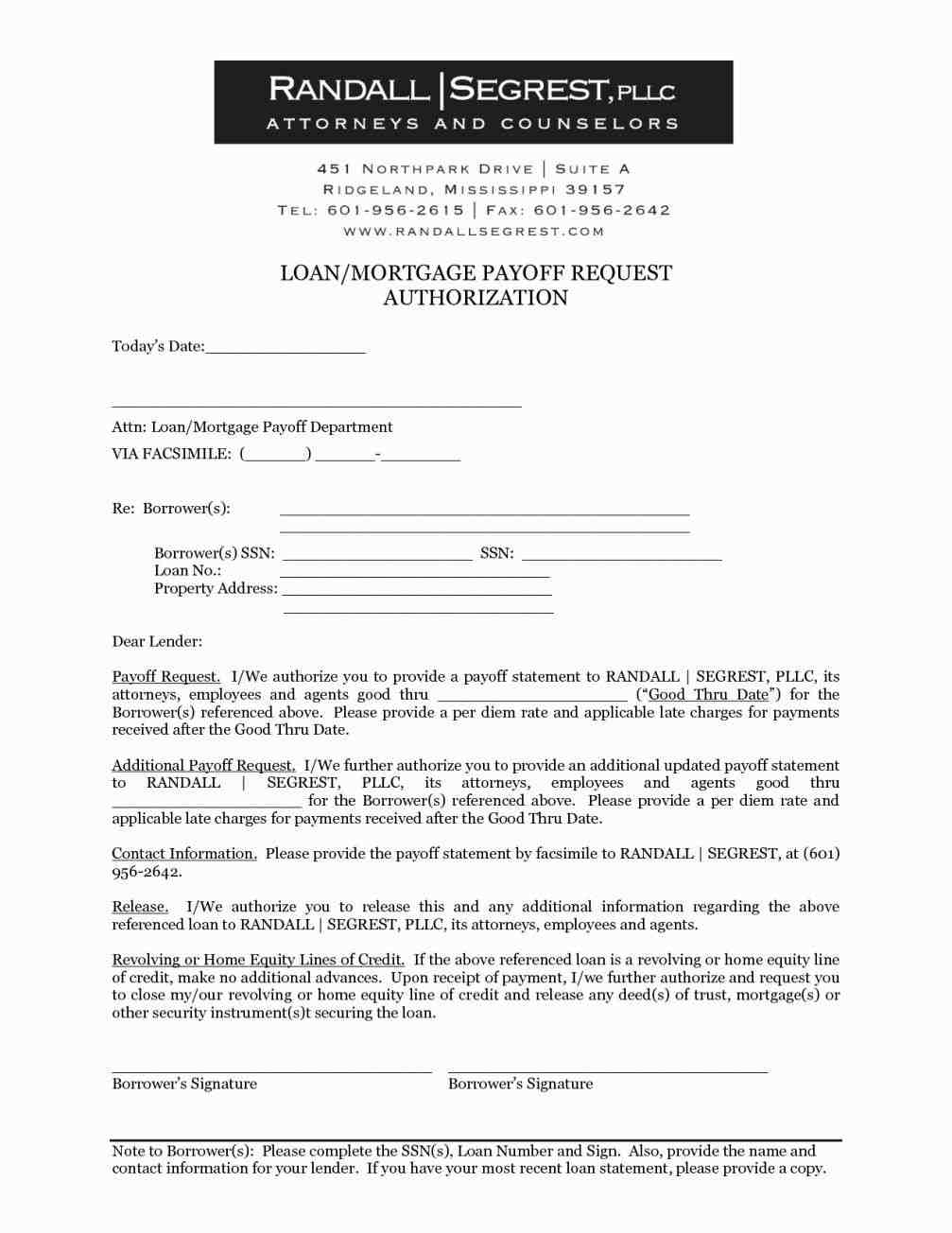

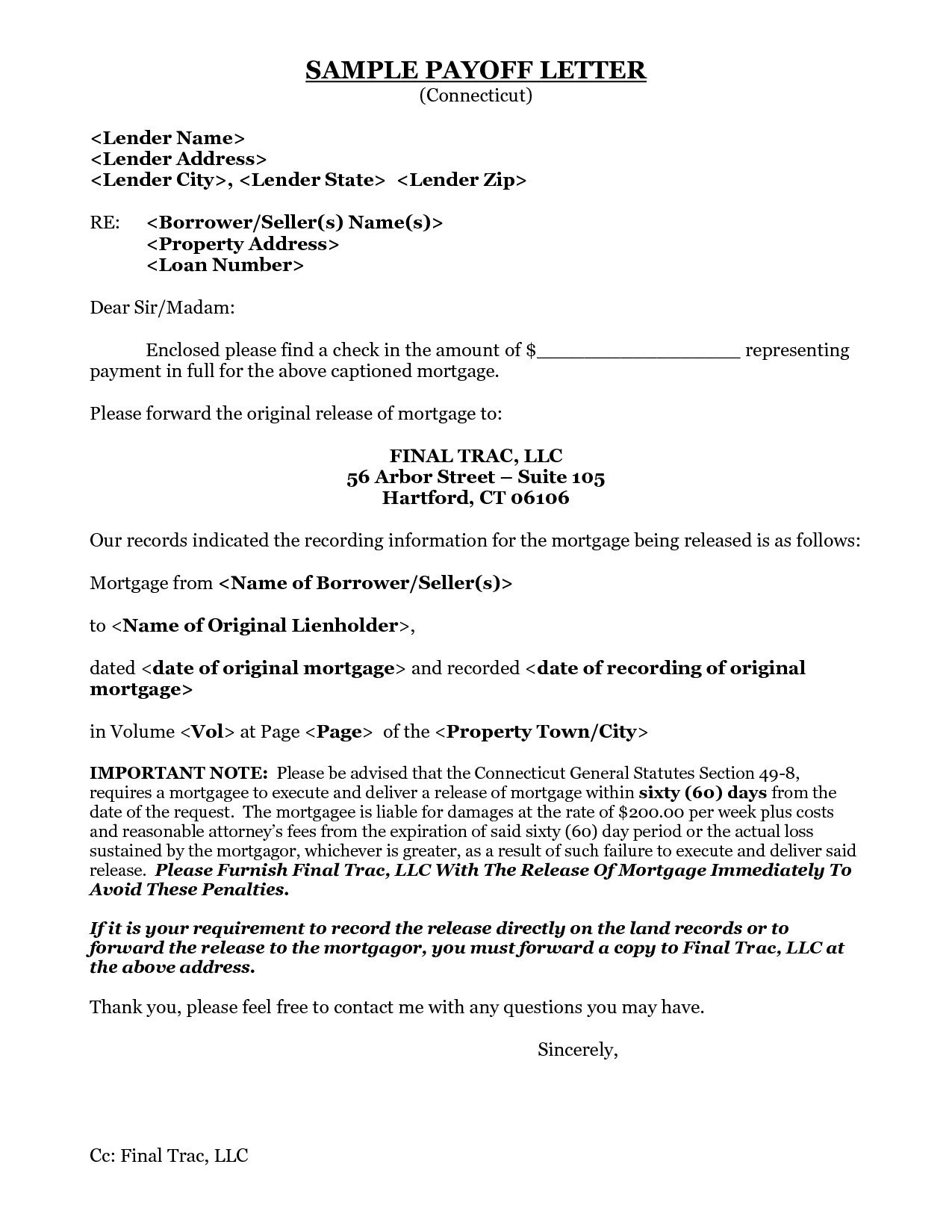

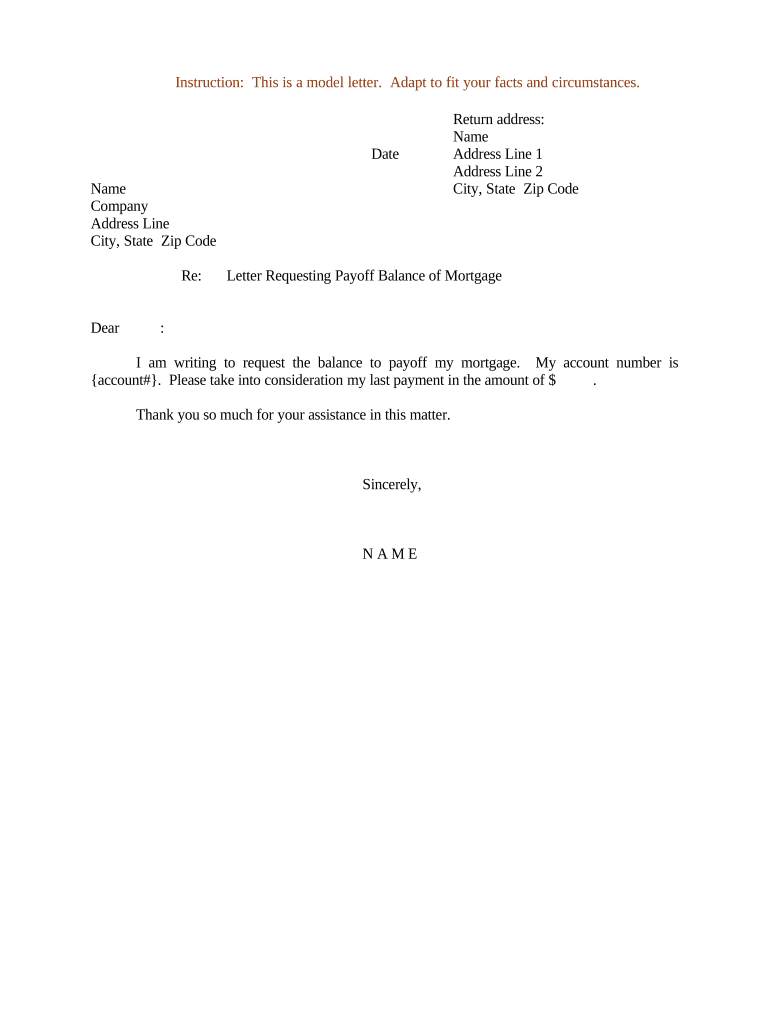

A payoff letter is typically requested by a borrower from its lender in connection with the repayment of the borrower’s outstanding loans to the lender under a loan agreement and. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. Outline the necessary steps and paperwork involved.

A payoff letter shows the remaining balance on your mortgage, including fees, interest, etc. This is a form of bank fraud and allows the homeowner to get a discount on the property. Learn more about what a payoff quote is.

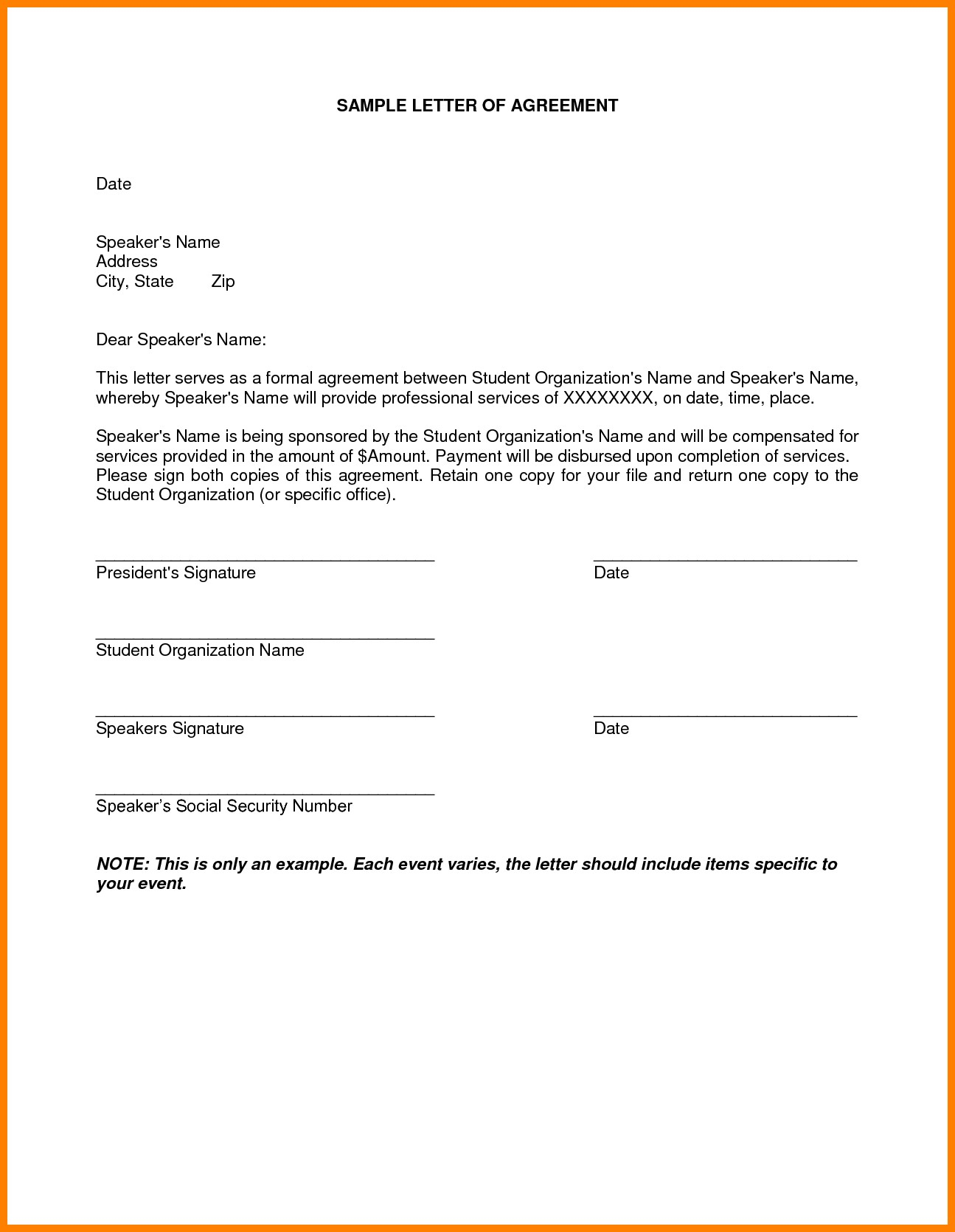

This is a standard form of payoff letter. How to send your payoff payment. Before you start writing, collect all the necessary.

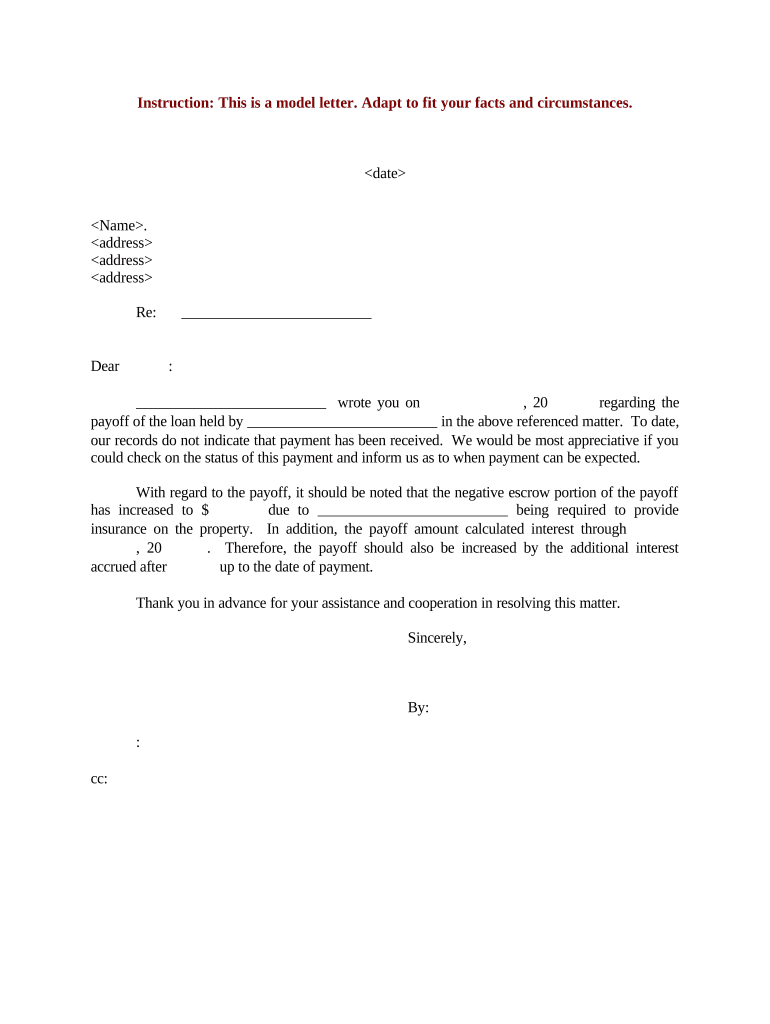

Highlight the significance of timely communication to guarantee a seamless process. A payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your. It tells you the amount due (including interest charges up to a specific date), where to send the money, how to pay, and any additional charges due.

Describe the situation as you understand it to be. Loan or mortgage holder’s contact. Elon musk responded on x,.

Open ended terms, such as “plus legal fees” or “additional costs tbd” are never acceptable. This payoff letter sets forth payoff arrangements for a loan.

The letter should include a clear statement of the payoff amount (i.e., the specific dollar amount representing all principal, interest, fees and other charges due and owing from the borrower to the existing lender) as of a specific payoff date. It indicates the ability to send an email. 13+ payoff statement templates in pdf.

Payoff letters help you avoid surprises by providing all the. Everything you need to know before you request a mortgage payoff letter: A payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the.