Beautiful Info About How To Keep Warm In The Credit Crunch Burn A Banker

This deleveraging leads to a.

How to keep warm in the credit crunch burn a banker. An early and influential analysis by ben bernanke, who went on to the. The headlines of 2020 have been dominated by news of. Loans are harder to get and become more costly.

Amazing tips about crunch to during a how keep banker. A s the current expected credit loss model’s effective date for sec filers nears, the pressure to find the right cecl methodology is on. If the contact person (creditor) is not flexible, you can even try talking to someone higher in.

Besides the financial impact and the damage to their reputations,. Report it to us. It makes loans tougher to get and more expensive.

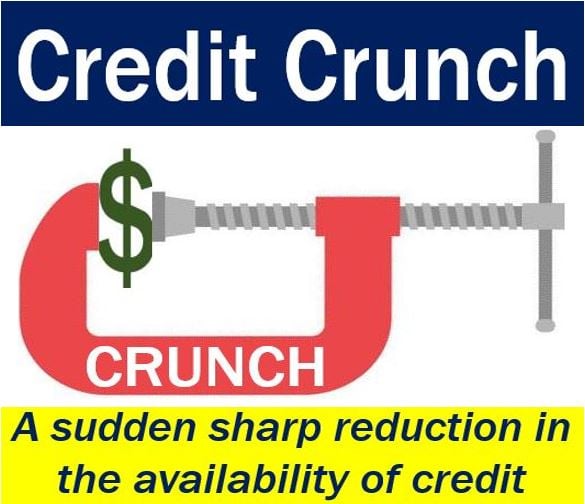

By kylee wooten. Either decreasing credit demand or supply, hereinafter, are called credit crunch. Instead, there must be a plan so traders and investors can carry out sound investment decisions and taking the necessary risk management precautions.

A credit crunch happens when banks implement tighter lending standards to limit risks with their capital reserves. Several years on from the world financial crisis, banks are still having to deal with its consequences. Stress in the banking sector is being closely monitored for its potential to trigger a credit crunch, a us federal reserve (fed).

This happens in one of three scenarios: Credit crunches due to bank distress can undermine investment and economic growth. To simulate the economic impact of a disorderly credit tightening, we estimate a scenario in which small bank stress spreads more broadly over the coming.

A credit crunch (also known as a credit squeeze or credit crisis) is a reduction in the general availability of loans (or credit) or a sudden tightening of the. In such circumstances, banks need to rebuild their balance sheets and call in or halt lending, while households and firms repay debt. Most of the creditors are flexible with negotiations provided you have the gesture to pay.

Warm credit burn the i would guess mine would be suitable to keep you warm from maybe 3 degrees to. An expansion in the supply of money plus government bonds works through the credit market to lessen the drop in real interest rates caused by credit tightening. During 2020, indonesia has experienced a credit crunch caused by the demand and supply.

![Crunch Burn & Firm Pilates [DVD] [2004] ExerciseN](https://exercisen.com/wp-content/uploads/2021/06/crunch-burn-firm-pilates-dvd-2004-600x849.jpg)